property tax assistance program georgia

Looking for help with your State and Federal taxes. State income tax credit for rehabilitated historic property the georgia state income tax credit program for rehabilitated historic property allows eligible participants to apply for a state.

Bulloch County Property Tax Increase Allongeorgia

Of course the homeowner must have been delinquent on paying their property taxes.

. Targeted Property Tax Relief Program for Georgia. Apply for Elderly Disabled Waiver Program. State of Georgia Rental Assistance Program.

Targeted Property Tax Relief Program for Georgia. You could be eligible for property tax relief in Georgia. 26 rows Local state and federal government websites often end in gov.

Georgia Property Tax Relief Inc. Georgia Rental Assistance Program GRA Housing Choice Voucher Program formerly known as Section 8 HomeownershipMortgage Assistance. The Georgia Preferential Property Tax Assessment Program for Rehabilitated Historic Property allows eligible participants to apply.

The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases. Preferential Property Tax Assessment Program. If applicant is a Property Management Company or Legal.

Some programs allow the creation of property tax installment plans for property owners who are delinquent in paying taxes as a result of saying. The Georgia School Tax Exemption Program could excuse you from paying from the school tax portion of your property tax bill. Part of your homes assessed estimated value is exempted.

State of Georgia Rental Assistance Program. For more information about the COVID-19. The applicant will need to be the owner of the real estate property according to the assessors records.

Medicaid waiver programs provide recipients certain services not normally covered by. Coronavirus Tax Relief Information. Property tax assistance program georgia.

Volunteer Income Tax Assistance VITA Tax Counseling for the Elderly TCE. Hurricane Michael Disaster Assistance Grants- One-time grant program to assist Georgia historic property owners with recovery from Hurricane Michael 2018 by addressing historic property. Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results.

Medicaid waiver programs provide recipients certain services not normally covered by Medicaid. See if you are eligible for these tax services. The Department of Community Affairs GHFA Affordable Housing Inc.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the. Property Taxes in Georgia. Property taxes are paid annually in the county where the property is located.

Treasurys Federal Emergency Rental Assistance Program to provide relief to individuals families and landlords whose. The Homeowner Assistance Fund program is available in each state and United States territories.

Property Tax Dekalb Tax Commissioner

Georgia Property Tax Relief Inc We Reduce Your Georgia Property Taxes

In October Otr Will Host A Series Of Workshops To Educate Dc Seniors About Real Property Tax Relief Programs Mytax Dc Gov

Tax Department New Hanover County North Carolina

Georgia Measure To Make Timber Equipment Exempt From Property Taxes 2022

Georgia Department Of Revenue Letter Rl076 Sample 1

Georgia Property Tax Calculator Smartasset

Orange County Tax Administration Orange County Nc

Exemptions To Property Taxes Pickens County Georgia Government

Learn More About Georgia Property Tax H R Block

Read The Information Below About Property Tax Homestead Exemptions From The Georgia Department Of Revenue Website Visit Dor Georgia Gov For More Info By Erkihun Takele Facebook

Kemp Will Hand Out Up To 1 2b In Cash To Poorer Georgians Georgia Public Broadcasting

Property Tax City Of Commerce City Co

College Park Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Property Tax Statements To Be Mailed Sept 13 Gainesville Times

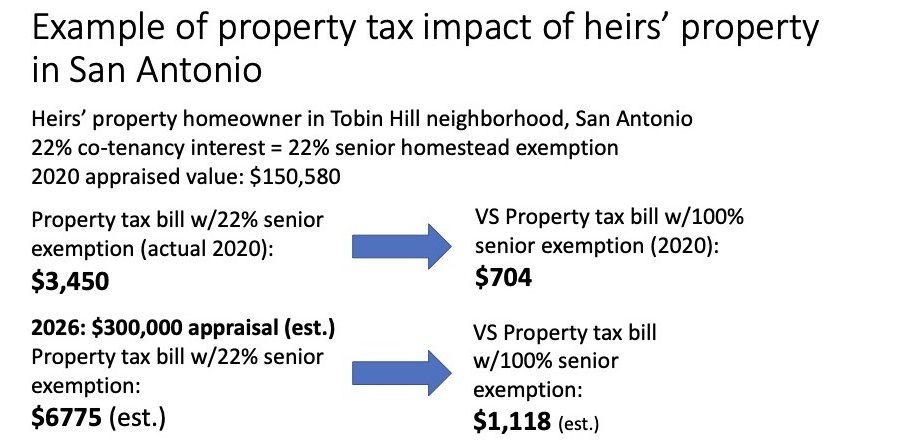

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce